Chinese E-commerce at a glance

China is the world’s biggest e-commerce market. With around 2.8 trillion USD sales made online in 2021, the Chinese online economy is over 3 times bigger than that of the United States. China is also the only country in the world where most purchases happen online and not offline.

The Chinese e-commerce stands out not only in size, but also in the way Chinese consumers shop online. First, the overwhelming majority of online purchases in China are made on mobile and on mobile apps like Taobao or JD, while only a minority of users purchase on websites.

Secondly, users’ eagerness to consume content online makes online buying a type of entertainment more than a necessity. Online consumers are very sensitive to recommendations by influencers and in user reviews, and video content like livestreaming is often the trigger to shopping behaviors.

Finally, Chinese users are very sensitive to price incentives when buying online. The majority of online sales in China occur during “shopping festivals” organized by the main apps where products are heavily discounted.

In a nutshell, these are the characteristics of e-commerce in China:

- Users buy mostly from mobile on local shopping apps;

- Users are very receptive towards content about products and their features;

- Online influencers and livestreaming are key ways to initiate interest towards making a purchase online;

- Consumers react very strongly to discounts and discount festivals.

Singles’ Day and online shopping festivals

The Chinese online buyers value price over anything else. While there is a growing number of sophisticated consumers who are willing to pay more for uniqueness of a product or brand, price is still the number 1 factor when Chinese consumers purchase online.

This sensitiveness to price has cultural roots and is not necessarily connected to purchasing power. China has a growing middle class and half of Chinese users spend over 1,000 USD a year online, more than many Western countries. However, they would also go at great length to find the most affordable available version of a product they like, and will be swayed to purchase if a product they like is discounted.

Such phenomenon is strongly encouraged by e-commerce platforms, who have created an entire calendar of “shopping festivals” during the year where products in store are discounted and where most online sales are generally made.

The most important of these festivals is Singles’ Day -also called 11/11- happening on November 11 each year. In 2021, the Singles’ Day sales of the two biggest e-commerce platforms combined, Taobao and JD, reached over 130 billion USD, an amount significantly bigger than the entire online economy of Luxembourg.

Other important shopping festivals are 618, happening on June 18, and 12/12, happening on December 12. However, trying to constantly spur online sales, e-commerce platforms in China have been constantly adding new festivals to their calendars, as well as making these festivals longer and longer, so that offers do not happen on a single day but rather stretch for a period up to 3 weeks before and after the day itself.

Preparing for shopping festivals is one of the main preoccupation of companies selling online in China, as the success of an entire year of business can be decided by the performance on these festivals. The focus on discount does not mean consumers buy low-priced products: the most performing categories on festivals are rather electronics, house appliances and apparel, especially of recognizable brands with high average ticket.

Cross-border e-commerce vs traditional e-commerce

Cross-border e-commerce (CBEC) is a regulatory framework that allows foreign companies to sell their products online in China without acting within the fiscal territory of China.

By launching online stores on platforms that support CBEC, companies can reach Chinese consumers greatly simplifying the preparation work in terms of logistics and bureaucracy. In 2021, including imports and exports CBEC in China reached a total market size of 14.6 trillion RMB (about $2.25 trillion), and has been growing steadily to become a valid alternative to traditional e-commerce in China.

Here are the main differences between e-commerce and CBEC in China.

Legal entity – To launch an online store in China, a company needs to have a legal entity registered in China. With CBEC, the company can use a foreign legal entity to sell directly to Chinese consumers.

Taxation – Selling online in China companies are subject to China import taxes and China retail VAT, whose amount varies depending on the product category. With CBEC, companies are subject to a single levy called “cross-border import VAT”, whose amount also varies but tends to be smaller than traditional e-commerce taxes.

Logistics – In traditional e-commerce, products need to be legally imported in China. With CBEC, products can be outside of China or physically but not fiscally in China in duty-free “bonded warehouses”. Import of the goods and payment of cross-border import VAT happens at the moment the consumer places the order.

Allowed products – Any products that are legally imported in China can be sold through traditional e-commerce. With CBEC, there are restrictions on the categories that can be sold to consumers, mostly related to medical devices and other sensitive product categories.

Others – Other advantages of CBEC over traditional e-commerce are that companies are not required to make modifications to the packaging of products in the original language, and that the only brand protection required Is a valid trademark registration in the home country.

E-commerce platforms in China

Here is a summary of the most noteworthy e-commerce platforms for both traditional and CBEC in China. These platforms and other alternatives are further described below.

Taobao

Taobao is China’s biggest e-commerce app. Owned by Alibaba Group, it has over 900 million active users and over 10 million merchants on the platform.

Originally a C2C platform comparable to eBay, it is now a marketplace gathering all sorts of merchants, from established brands to individual sellers. Taobao has a complex ecosystem of connected platforms where consumers can interact with merchants and products in diverse ways, including livestreaming. Consumers pay on Taobao via Alipay, the mobile payment system owned by Alibaba Group.

Taobao is a preferred options for local vendors due to its low barrier of access and large userbase, however foreign companies tend to choose other platforms to sell online that can guarantee a higher degree of control and official status.

Tmall

Tmall is the B2C platform of Alibaba. Because merchants and products selling on Tmall are also appearing on Taobao, Tmall can be considered as simply part of the Taobao ecosystem.

Tmall is a preferred option for international brands who want to establish a primary online store in China, as they can gain access to Taobao’s userbase while advertise themselves in an official way. To many companies, a Tmall official store in China is regarded as the equivalent of an official website in other markets.

JD

Also known as Jingdong or JD.com, it is the second biggest e-commerce in China. Born as a marketplace for electronics, JD has expanded over the years and now caters to a wide audience selling products in several categories. It has over 580 million active users.

JD also has a multi-platform ecosystem, largely features livestreaming and has a calendar of discount-focused shopping festivals. Consumers pay via WeChat Pay, the mobile payment system owned by its shareholder Tencent Group.

Companies can open official stores on JD that appear and function in a similar way to a Tmall store.

Tmall Global / JD Worldwide

Both Tmall and JD have sections of their marketplaces dedicated to CBEC. These sections, called Tmall Global and JD Worldwide respectively, are the most common option for CBEC merchants.

Companies selling on Tmall Global and JD Worldwide are required to use an integrated logistics system and store products in bonded warehouses managed by the platforms. By following store opening and product listing procedures of the platforms, companies are already compliant to CBEC regulations.

For more official platform info on how to open a store on Tmall Global visit here (in English).

For official rules and eligibility about a store on JD Worldwide visit here (in Chinese).

https://www.jd.hk/rulePage/UdWcT8T0UdV1TdTd.html

WeChat Miniprogram

WeChat Miniprograms are not a platform per se but rather an interface that allows companies to create and manage apps inside WeChat, China’s biggest social networking app.

Miniprograms are highly customizable by the operating company and have the advantage of being connected to WeChat, so that users do not need to download a new app but can simply open the Miniprogram from within WeChat.

While all sort of Miniprograms can be designed, companies have widely used this interface to create online stores that live inside WeChat and can be connected to a company’s existing official WeChat account. A Miniprogram store allows users to pay for products via WeChat pay.

Other e-commerce platforms

There are of course many more e-commerce platforms that are popular within Chinese users, especially within specific product verticals. A few notable ones are Hema, a grocery app also owned by Alibaba Group; Suning Yigou, an e-commerce specialized in electronics and home appliances; Ctrip, China’s biggest online travel agency; Dewu, a fashion e-commerce popular among young consumers.

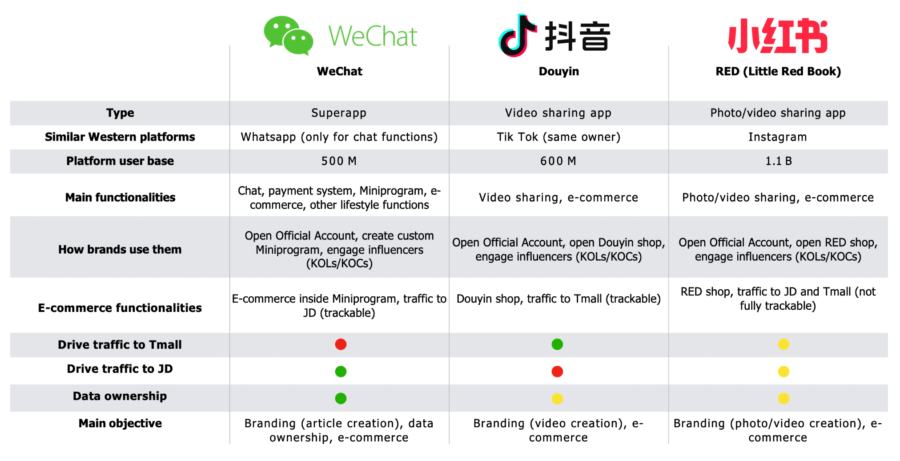

In addition, many Chinese social networking apps try to appeal to consumers becoming “superapps” which combine several functionalities including e-commerce inside a single app. Both Little Red Book and Douyin, two important social networks, have e-commerce functionalities and companies can consider selling on them especially if they already have official accounts open on the platforms that they use for marketing and communication purposes.

Selling via CBEC is technically possible on any platform as long as products are in a bonded warehouse that supports CBEC shipping, and they are registered in a special database of the Chinese Customs.

At the moment, however, CBEC on WeChat Miniprogram or another e-commerce platform in China is not as straightforward as Tmall Global or JD Global, and technical support by a specialist provide is required before a company is fully compliant with CBEC.

Finally, as the regulatory framework of e-commerce and CBEC in China is very dynamic and constantly updating, the above information is provided for reference only, and it is recommended to consult a specialist before committing to a CBEC project.